Apply margin to cost

Investopedia ranks the best discount brokers for low-cost trades low margin rates fractional share trading and low-cost options to save you money. Production or acquisition costs not including indirect fixed costs like office expenses rent or administrative costs then divided by the same.

Profit Margin Calculator In Excel Google Sheets Automate Excel

Additional terms and conditions may apply.

. Every time a sale is made the cost of expenses must be taken out of the sale. In cases of suspected ear margin hyperkeratosis your veterinarian may need to rule out other possible medical conditions first. The margin requirement for a credit spread in a retirement account is the greater of the difference in strike prices and the 2000 cash spread reserve.

Therefore the firm can sell more or choose to have a bigger profit margin. How Much Does Opening a Bar Cost. Margin may be brought in year on year basis as and when disbursements are made on a pro rata basis.

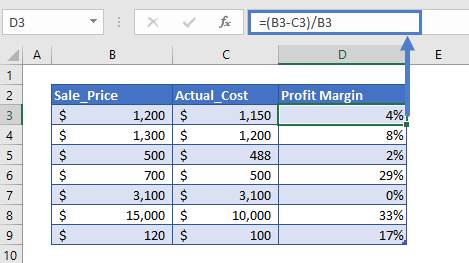

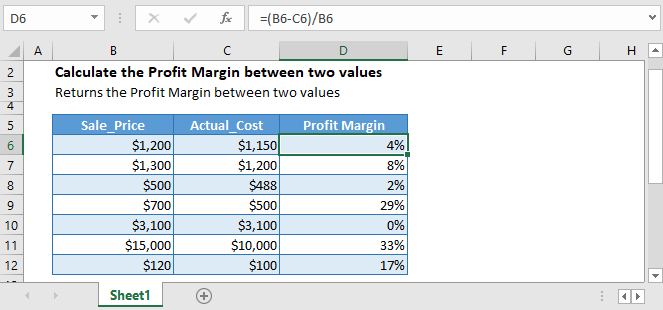

The range for average restaurant profit margins typically lies between 0-15 but the average restaurant profit margin usually falls between 3-5. How to Calculate. Each item in the table has different price and cost so the profit varies across items.

A fall in the exchange rate makes exports cheaper to foreign buyers. Indias first personal line of credit. Calculating variable costs can be done by multiplying the quantity of output by the variable cost per unit of output.

For example fly bite dermatitis in dogs causes very similar symptoms as to those of ear margin hyperkeratosis. It is not a fee or cost and is freed up again once the trade is closed. Eligible Fidelity account with 50 or more.

When losses cause a traders margin to fall below a pre-defined stop out percentage one or all open positions are automatically closed by the broker. Margin is the capital a trader must put up to open a new position. Security Collateral security from Max 100 to Min 50 Assignment of future income of the student Loan granted jointly with parentguardian and student.

If a firm relies on exports a depreciation in the exchange rate will increase profitability. 10 of Loan amount. The average cost of opening and running a bar for the first year is about 710400.

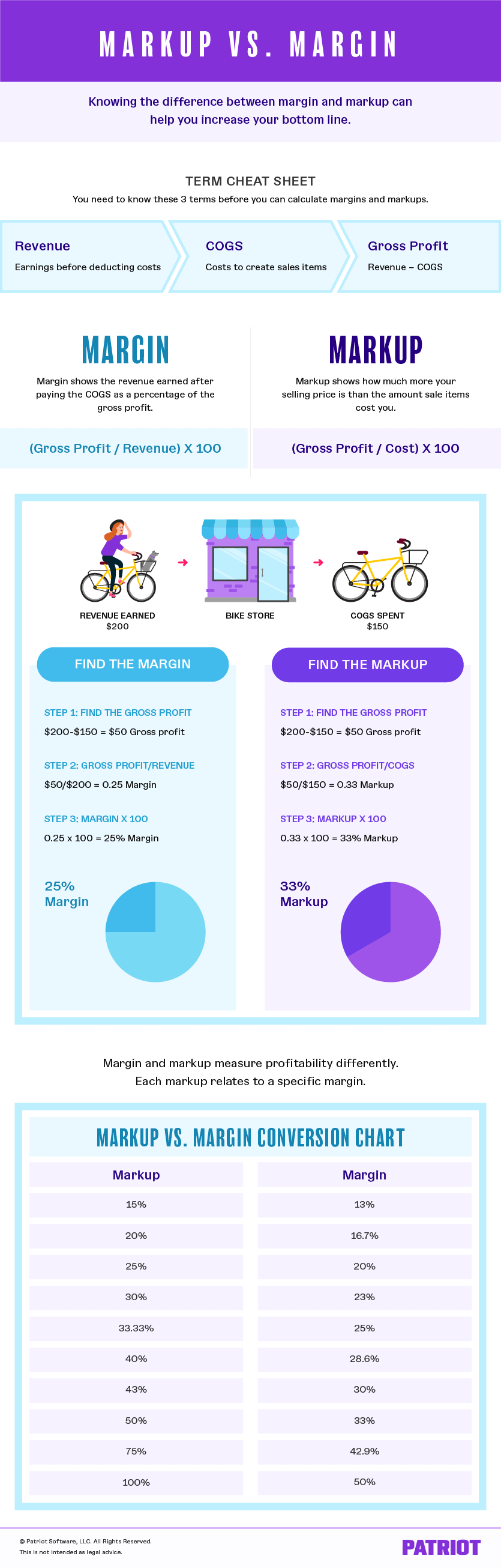

Profit margin is calculated with selling price or revenue taken as base times 100. Promotion is void where. Its purpose is to protect the broker from losses.

Additional diagnoses she may need to rule out include scabies and solar dermatitis to just name a few. Restaurant profit margin is the percentage of each dollar of sales that counts towards your profits. The margin requirement for a debit spread in a retirement account is the initial debit paid to execute the trade plus a cash spread reserve of 2000.

If the firm imports raw materials a depreciation will increase costs of production. Profit margin is simply a method to express this in a percentage. The average cost of opening a bar is 420000.

In this example the goal is to calculate and display profit margin as a percentage for each of the items shown in the table. Margin rates can vary from one brokerage to the next and there are different factors that affect the rates brokerages charge. Suppose ABC Company produces ceramic mugs for a cost of 2 per mug.

A Leveraged margin loan boosts your investment power to build and grow your investment portfolio with shares ETFs etc. A margin rate is the interest rate that applies when investors trade on margin. 1 day agoThis model allows you to apply dollar-cost averaging to real estate by investing a fixed amount even as little as 100 in real estate on a weekly bi-weekly or monthly basis.

Transfer money to your bank account 24x7 and pay interest only on the amount you withdraw. Gross margin is the difference between revenue and cost of goods sold COGS divided by revenue. Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook.

In other words given a price of 500 and a cost of 400 we want to return a profit margin of 20. Apply Now or call 1300 307 807. The amount of money left over after all expenses are accounted for is profit.

Gross margin is expressed as a percentageGenerally it is calculated as the selling price of an item less the cost of goods sold e. It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment so. Margin rates determine the cost of borrowing for the investor.

How To Calculate Markup And Margin For Retail The Easy Way

Margin Calculator

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Profit Margin Calculator In Excel Google Sheets Automate Excel

Download A Free Cocktail Cost Calculator For Excel Great Tool That Helps To Determine The Cost Of Cocktail By Summarizing The Cost O Cocktails Cost Calculator

Gross Profit Margin Formula And Calculator Excel Template

Recipe Cost Calculator For Excel Food Cost Food Truck Menu Menu Restaurant

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Excel Formula Get Profit Margin Percentage Exceljet

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

Distribution Channel Margin Calculator For A Startup Plan Projections Start Up Channel Distribution

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Product Pricing Calculator Handmade Item Pricing Worksheet Etsy Business Template Pricing Calculator Product Pricing Worksheet

Margin Markup Calculator And Converter Double Entry Bookkeeping Bookkeeping Double Entry Calculator

Margin Vs Markup Chart Infographic Calculations Beyond

Differences Between Contribution Margin Vs Gross Margin Contribution Margin Gross Margin Contribution

Markup Vs Margin Chart Infographic Calculating Margin Markup Chart Infographic Profit And Loss Statement Finance Investing